We hold these truths to be self-evident ….

That the people of all counties are created equal, that they are endowed with certain Rights.

That to secure these rights, Governments are instituted among people, deriving their just powers from the consent of the governed.

That whenever any leaders of Government become destructive of these ends, it is the Right of the People to alter or to remove them.

The inept and often corrupt leadership of Chicago and Cook County Chicago , has conspired essentially to colonize the County of Will County Democrats shown that their loyalty is to Chicago politicians and not to the residents of Will County

The new congressional map sliced Will County Chicago

· All Democratic Will County State Representatives and State Senators voted in favor of this map which gives control to Cook County

· Will County Democrat

· In the middle of the night on the last day of the lame duck session, Chicago Will County

· Our sales tax collected in Will County

· Will County residents provide the majority of school district funding. Chicago

· While Will County

· Will County Democratic leaders have used their positions for personal and family enrichment by providing free state

· Like the hereditary monarchy of England in 1776, Will County Democratic leaders have by-passed the primary election process to appoint to offices their friends and relatives like Larry Walsh Sr., A. J. Wilhelmi, Pat McGuire, and Larry Walsh Jr., who are loyal to the Chicago controlled Democrat machine instead of loyal to the citizens of Will County.

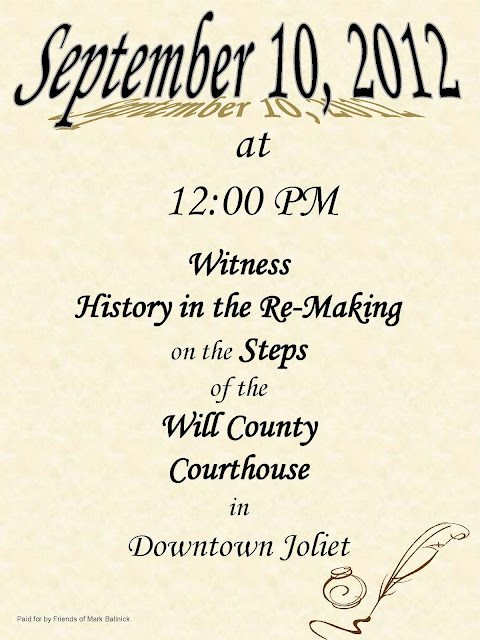

We, therefore, declare Will County

· Faithfully serve the citizens of Will County

· Stand strong against Chicago politicians taxing Will County residents to bail out Chicago and Cook County

· Promote spending cuts over tax increases.

· Support the election process and protect the right of Will County

· Restore integrity to Will County

· Open employment and contractual opportunities to all Will County